Week 51/2023 – Central Vietnam Real Estate News Summary

In this weekly or sometimes bi-weekly news flash – CVR: Central Vietnam Realty will provide a choice of articles from mainly Vietnamese media sources related to the real estate market in Vietnam.

We will be focusing on issues related to Da Nang and Hoi An, while also looking at national news and their possible impact on Central Vietnam’s property market.

You will find a summary, a link to the source as well as CVR’s take on the article.

We believe that local knowledge is the key to making the best possible decision and that’s what we offer to all our clients.

“CVR: Western Management – Local Knowledge”

-

1. Da Nang to Enhance Access to Credit Capital for Businesses and Residents

Da Nang has unveiled plans to stimulate economic growth by improving access to credit capital for both businesses and residents, in collaboration with local banks and the State Bank of Vietnam. The primary focus is on supporting small and medium-sized enterprises (SMEs), which constitute over 90% of businesses in Da Nang. Many SMEs face challenges in obtaining capital due to stringent requirements and high-interest rates. The city government is partnering with local banks to create tailored loan products for SMEs with lower interest rates, extended repayment terms, and flexible collateral requirements. Financial assistance, such as loan guarantees and credit subsidies, will also be provided to SMEs.

In addition to supporting businesses, the initiative aims to broaden credit access for residents through measures like establishing credit cooperatives, expanding mobile banking services, and implementing a credit rating system for individuals. The overarching goals include promoting economic growth by enabling businesses to invest and expand, improving living standards through affordable loans for homes and education, and boosting the real estate market.

The real estate market in Da Nang is anticipated to benefit significantly from increased access to credit capital. With more people able to afford homes, there is expected to be heightened demand for housing, leading to increased property prices and greater investment in the real estate sector. The availability of affordable loans is also expected to facilitate financing for new construction projects, further contributing to the growth of the real estate market in Da Nang. Overall, the initiative is seen as a positive step toward creating a conducive environment for economic prosperity and growth in the city, with anticipated positive impacts extending to the real estate sector.

Source: thoibaonganhang.vn

-

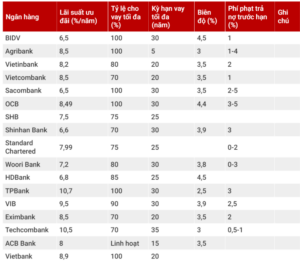

2. The lowest interest rates for home loans in Vietnam in December 2023

According to a survey by batdongsan.com.vn, interest rates for home loans in Vietnam in December 2023 range from 6-10.99% per year, applied for short-term periods of 3-6 months.

After the grace period, floating interest rates fall to around 9.5-13% per year.

The article also notes that interest rates for home loans from banks can change from time to time depending on the bank’s lending policy. To get detailed advice on home loan packages, customers should contact the bank directly.

The banks with:

The lowest preferential interest rates:

• Standard Chartered Bank: 6.79% per year

• Woori Bank: 7% per year

• Shinhan Bank: 7.29% per year

• Hong Leong Bank: 7.39% per year.

Average preferential interest rates:

• VPBank: 5.9% per year

• HDBank: 8.2% per year

• Vietcombank: 8.1% per year

• Vietinbank: 8.3% per year

• BIDV: 8.5% per year

High preferential interest rates:

• Agribank: 9.9% per year

• MB Bank: 10.2% per year

• Techcombank: 10.39% per year

• VPBank: 10.99% per year

Source: batdongsan.com.vn

-

3. There is a money-making “niche” market that not all real estate investors know about

Cushman & Wakefield Vietnam reveals untapped real estate niches poised for significant growth, emphasizing specialized sectors such as data centers, healthcare, scientific research, cold storage, worker/social housing, elderly care homes, rent-to-buy properties, and personal storage.

Elderly care homes emerge as a future profit avenue due to the rising demand for housing and related services.

Additionally, cold storage real estate gains traction in Vietnam, fueled by strong domestic demand and the boom in e-commerce.

The country’s data center market is recognized as one of the world’s fastest-growing, driven by digitalization, 5G adoption, and local data localization laws. This presents an enticing prospect for investors in Vietnam’s evolving real estate landscape.

Source: cafef.vn

-

4. What type of real estate will investors prioritize in 2024?

The study suggests a potential decrease in land prices in the short term. However, anticipates a long-term increase due to infrastructure development and economic growth. Buyers increasingly rely on data for informed decisions, emphasizing the need for quality and legal compliance in real estate projects. Experts also stress the importance of government support in overcoming financial pressures for developers. Additionally, it ensures sustainable supply while safeguarding buyer rights.

Source: baohaiduong.vn

-

5. What does the Director of the Department of Justice in Da Nang say about the situation of consignment land documents causing distortions in the real estate market?

The article discusses the issue of tax losses for the city budget due to irregularities in the activities of notary public offices in Da Nang, Vietnam. Trần Thị Kim Oanh, the Director of the Department of Justice in Da Nang, responds to questions about the manipulation of land documents affecting the real estate market. The manipulation involves consignment and waiting for transactions with banks and services, leading to unhealthy competition among notary offices. This situation results in significant tax losses, with criminals taking advantage of it for fraud and asset misappropriation.

Despite some corrective actions, members of the legislative body emphasize the need for stronger involvement from law enforcement, particularly the police. They argue that a more robust solution is required to ensure a healthy real estate market and to curb fraudulent activities related to consignment and waiting transactions. The Chairman of the City People’s Council urges the Department of Justice to work closely with the police and proposes new operational solutions for effective oversight. The Director of the Department of Justice commits to intensifying inspections, coordinating with relevant agencies, and proposing solutions to ensure the safety of organizations and individuals in the city.

Source: cafef.vn

6. Surging Housing Prices in Hanoi, Partial Decrease in Ho Chi Minh City Creates Varied Real Estate Landscape

The current trends in housing prices in Hanoi and Ho Chi Minh City. In Hanoi, both the primary and secondary markets for condominiums are experiencing a surge in prices. New projects, especially in the western areas outside Ring Road 3, are rumored to have prices approaching those in central districts.

According to VnExpress, the Hanoi apartment market has experienced a surge in both primary and secondary segments from the beginning of the year until now. Some upcoming projects in the western area, outside the Ring Road 3, are rumored to have prices approaching those in the central district. For instance, a project with 9 towers and 4,000 units is expected to be priced at around 66 million VND per sqm. Meanwhile, in Ho Chi Minh City, there is a partial decrease in housing prices, with some apartment projects reducing prices by 15-20% since the second half of the year.

-

-

As always, CVR is at your service and happy to provide help anyways we can!

Contact Us today to find the real estate investment in Da Nang that is right for You.

-