-

Week 48/2023 – Central Vietnam Real Estate News Summary

In this weekly or sometimes bi-weekly news flash – CVR: Central Vietnam Realty will provide a choice of articles from mainly Vietnamese media sources related to the real estate market in Vietnam.

We will be focusing on issues related to Da Nang and Hoi An, while also looking at national news and their possible impact on Central Vietnam’s property market.

You will find a summary, a link to the source as well as CVR’s take on the article.We believe that local knowledge is the key to making the best possible decision and that’s what we offer to all our clients.

“CVR: Western Management – Local Knowledge”

-

-

1. New trends in the real estate market

-

-

-

Real estate buyers are placing increasing importance on the quality, legality, and sustainability of real estate projects. This necessitates investors to enhance product quality, ensure project legality, and meet the demands of buyers.

Investors need to persuade customers with the core value of their products, emphasizing clear legality, sustainable finances, and a strong reputation. To remain competitive in the market, investors must focus on the essential aspects of their offerings, including quality, convenience, services, and location.

Both real estate buyers and investors are relying more on data-driven decision-making. Data analysis enables them to assess the market, evaluate projects, and make informed investment choices.

Cash flow real estate, such as apartments and private houses, is gaining priority in real estate investors’ portfolios. These types of properties provide regular cash flow, making them attractive investment options.

The article also highlights other trends in the real estate market, such as the development of technology-driven real estate, resort properties, and suburban resort real estate.

- Source: Cafef.vn

-

2. Vietnam’s Industrial Real Estate Attracts Foreign Investors, With China Leading the Pack

Source: cafef.vn

-

3. Navigating Vietnam’s High-Quality Office Space Dilemma

Mr. David Jackson, General Director, Avison Young Vietnam shared that as Vietnam strives to compete in the region to attract foreign investment, the longstanding shortage of high-quality office supply may become even more serious. Will this open up investment opportunities?

Market “demand exceeds supply.”

In the central districts (CBD) of Hanoi and Ho Chi Minh City, where most multinational corporations are headquartered, high-rise buildings are crowded together. However, what is happening in the Vietnamese office market is a worrying problem: A prolonged shortage of high-quality office space.

While the office segment in major international markets is struggling due to reduced occupancy, most Grade A office buildings in Hanoi, Ho Chi Minh City and Da Nang maintain an occupancy rate of over 85 % quarterly, from the beginning of 2023. The vacancy rate is even lower than 5% in some LEED certified buildings in the central city area. HCM (German House Ho Chi Minh City, Friendship Tower…).

For Vietnam to promote its advantages and compete in the race to attract high-quality foreign capital, it needs a new vitality for commercial real estate, including the office segment. With the demand for high-quality office space in the big cities like Ha Noi, Ho Chi Minh, Hai Phong, Da Nang, there is a demand of the good office spaces. In the coming time, The One Tower will be started to build, hopefully can provide a luxury office space for companies, tenants…

Source: cafebiz.vn

-

4. Controversy about the ‘shocking’ increase in parking prices, a series of cars with locked wheels in Hanoi apartments

Artemis luxury apartment investors (3 Le Trong Tan, Thanh Xuan, Hanoi) have announced an increase in parking fees for cars and motorcycles.

The investor insists that the fees are in compliance with regulations and justified by the advanced parking facility’s investment. Tensions escalate as some cars are wheel-locked in the apartment’s garage, allegedly blocking exits intentionally. The district People’s Committee requests the investor to base the pricing on local regulations.

Legal experts state that the investor’s actions may be inappropriate, and the police are investigating various issues, including fire safety compliance and previous administrative violations

Source: vietnamnet.vn

-

5. Da Nang Transforms an Industrial Zone into An Don International Financial District

-

In a significant development, Da Nang, is undergoing a transformation as it converts an existing industrial zone into a thriving international financial district called An Don. This ambitious project aims to create a modern urban center, positioning Da Nang as a new economic hub.

The decision to convert the Da Nang Industrial Zone into An Don International Financial District was approved as part of the city’s long-term planning until 2030. This strategic move aligns with the government’s vision to develop Da Nang as a high-tech industrial and supportive industry hub.

As part of the industrial development, Da Nang will establish additional industrial zones and clusters. The existing Da Nang Industrial Zone will be transformed into An Don International Financial District, serving as a modern urban center and the city’s new economic focal point.

To facilitate industrial expansion, Da Nang has devised a relocation plan for the current industrial zone. With 42 active businesses under the ownership of Massda Land Co., the local authorities are in the process of relocating factories and warehouses to new premises.

The Son Tra district, where the industrial zone is located, holds significant potential for tourism development and has a dense population. Transforming the industrial zone into a financial district near the city center will greatly impact the quality of life for residents. This conversion aligns with the realities and future development direction of Da Nang.

Apart from the transformation of Da Nang Industrial Zone, the Hoa Khanh Industrial Zone will also be converted into an ecological industrial model. Additionally, three new industrial zones will be established: Hoa Cam (phase 2), Hoa Nhon, and Hoa Ninh, covering a total area of approximately 880 hectares.

The conversion of Da Nang’s industrial zone into An Don International Financial District signifies a major step towards economic growth and urban development. This transformation aligns with the city’s vision of becoming a prominent high-tech industrial and financial center in Vietnam. By repurposing the industrial zone, Da Nang aims to enhance its economic landscape and create a modern urban environment.

Source: vneconomy.vn

-

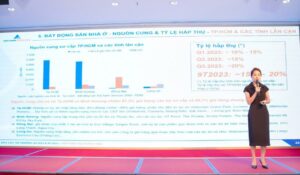

6. The real estate market is expected to recover from the second quarter of 2024 and show significant growth from 2025 onwards

The real estate market is poised for a recovery, expected to commence in the second quarter of 2024 and exhibit substantial growth from 2025 onward. Despite ongoing efforts to alleviate market challenges, policies aimed at promoting recovery have not yet proven highly effective. The global economic situation remains unfavorable, contributing to a lack of full market confidence recovery.

In the residential real estate segment, primary market apartment prices are annually increasing by 2-3%. Key markets witness about 90% of primary supply in the third quarter of 2023 coming from existing projects. The Central region, particularly Da Nang, experiences an increase in new supply. Diverse property prices are observed in the Central market, with the absorption rate in the third quarter reaching around 10%.

The DXS-FERI forecast indicates that the real estate market is at the final stage of the downturn, approaching recovery in a U-shaped pattern. The recovery is expected to initiate in the second quarter of 2024, starting in major cities and gradually extending to satellite cities. Positive prospects include the Federal Reserve halting interest rate hikes, manufacturing plants shifting to advantageous markets, and reductions in operating and lending rates by the central bank and commercial banks, fostering confidence in economic recovery.

Source: vneconomy.vn

-

-

As always, CVR is at your service and happy to provide help anyways we can!

Contact Us today to find the real estate investment in Da Nang which is right for You.

-

Investors need to persuade customers with the core value of their products, emphasizing clear legality, sustainable finances, and a strong reputation. To remain competitive in the market, investors must focus on the essential aspects of their offerings, including quality, convenience, services, and location.

Investors need to persuade customers with the core value of their products, emphasizing clear legality, sustainable finances, and a strong reputation. To remain competitive in the market, investors must focus on the essential aspects of their offerings, including quality, convenience, services, and location. As part of the industrial development, Da Nang will establish additional industrial zones and clusters. The existing Da Nang Industrial Zone will be transformed into An Don International Financial District, serving as a modern urban center and the city’s new economic focal point.

As part of the industrial development, Da Nang will establish additional industrial zones and clusters. The existing Da Nang Industrial Zone will be transformed into An Don International Financial District, serving as a modern urban center and the city’s new economic focal point.