Each week we post a news flash with notable articles related to the real estate market in Vietnam. We asked our team to pick the top stories from the past month and we’ve tallied the results. Check out the headlines that made big news in our office below. Have any of the articles we’ve shared impacted you? Is there any important news we’ve missed? We’d love to hear from you!

We hope you and your loved ones are staying safe and healthy. The CVR team is here to answer your questions at any time. Whether buying, selling, renting, or opening a business, contact us to talk about your real estate needs today.

Your Friends at Central Vietnam Realty.

___________________________________

Content

1. Real estate transactions in the province: buyers reveal their experience to avoid risks

2. Real estate credit tightening: Cash flow is congested, real estate market is thirsty for supply

3. Which segment is the focus of the real estate market?

4. What should be considered before pouring capital into the rental market?

6. New wave of FDI landed in industrial zones

8. High-end apartment prices escalate due to the scarcity of supply?

-

-

MAY 2022 CENTRAL VIETNAM REAL ESTATE NEWS SUMMARY

-

-

1. Real estate transactions in the province: buyers reveal their experience to avoid risks

Experience in putting money into provincial real estate: understand detailed information, accurately, grasp the trend of the market as well as avoid the places that are “feverish”.

fluctuations, buyers need to prepare a good financial plan, limit the use of leverage, and should quickly update information related to the market, avoiding buying according to the current situation. trend and according to local information on land fever.

Survey the market on price and population growth to find out the demand, go to notary offices to see if the transaction volume is really high or not.

Why it is important: It helps investors have objective assessments, helping them make the right decisions.

Source:https://chototphanrang.com/giao-dich-nha-dat-o-tinh-nguoi-mua-tiet-lo-kinh-nghiem-tranh-rui-ro/

-

2. Real estate credit tightening: Cash flow is congested, real estate market is thirsty for supply

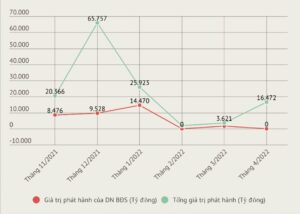

The tightening of credit in real estate (real estate) will make the market hungry for capital, and supply will decrease.

A recent report of the Ministry of Construction shows that, in the first quarter of this year, only 22 commercial housing projects were completed with more than 5,000 units, equal to about 47% compared to the fourth quarter of last year.

Unreasonable real estate prices.

The latest statistics of market research unit Batdongsan.com.vn show that the average selling price of Hanoi apartments in the first 4 months of 2022 has increased by 9% compared to the average price in 2021. This figure is much higher than the average growth rate of about 5-8% in the first 3 months of the year.

Why it’s important: It is necessary to change the approach in the direction of ensuring credit for reputable investors, having feasible projects, implemented on schedule, good liquidity, and good debt repayment ability.

Interested in investing in Vietnam? We cooperate with local and international brands to offer our clients the best opportunities available. Contact our sales team for more information today!

Source:https://cafef.vn/siet-tin-dung-bds-dong-tien-nghen-thi-truong-khat-nguon-cung-20220519034214912.chn

-

3. Which segment is the focus of the real estate market?

While in the apartment segment, the whole country had a total transaction of only 45.5% compared to the previous quarter and 80% compared to the same period in 2021. The land plot segment dominated when there was a sudden increase in transaction volume. 242% compared to the fourth quarter of 2021.

The land plot segment had a sudden increase in transaction volume.

In some places, the price level increased by 15-20% compared to the end of 2021, similar to the end of the first quarter and the beginning of the second quarter of 2021, but the spread and the price increase margin were lower.

The project’s land type and land plots are of increasing interest in many provinces.

From 2021, a lot of capital flows will be drawn from other economic sectors to switch to finding effective investment channels such as real estate. Therefore, the market has more and more F0 investors, also known as side-by-side investors.

CVR is here to help you understand the trends of the market so you can make the best investment decisions. Our experience, highly regarded reputation and strong legal knowledge keep us at the forefront of the real estate industry. Interested in learning more about opportunities in Central Vietnam? Contact the CVR team today!

Source:https://cafef.vn/tam-diem-thi-truong-bat-dong-san-dang-don-ve-phan-khuc-nao-20220508011530132.chn

4. What should be considered before pouring capital into the rental market?

5. Number of Transactions decrease, prices still increase: A “strange” phenomenon in the real estate market?

The problem of the current real estate market is the imbalance between supply and demand:

The first reason: The difference is big because of the large investment demand, people and families like to invest in real estate, but do not want to invest in production and business because of low efficiency, precariousness, and current purchasing power is still weak.

There are new projects just starting up, new compensation for site clearance, at most leveling, building a few roads, have no value there but also become rare and scarce goods in the market and increase prices.

This leads to an increase in the price of land outside the market, investors who think that there are no formal goods, go to buy illegal goods like the land from the people. Therefore, traders and speculators jumped in and blew the price to create waves. In feverish places, the anchor price is too high, there will be no buyers, and the liquidity will decrease.

It is important because the supply of real estate is too low, almost nonexistent, while the high demand leads to speculation, and traders inflate prices so there are no buyers. Experts said that it is necessary to adjust policies, regulate projects, and bring more goods to the market.

6. New wave of FDI landed in industrial zones

7. Real estate in the East of Quang Nam welcomes good news from 2 approved projects of nearly 5,000 billion VND

The project of dredging the Truong Giang River and building 6 bridges across the river is expected to be implemented from 2022 to 2027, in order to strengthen the connection of key coastal economic zones, as well as residential areas and tourist areas, creating a smooth and synchronous transportation system.

The investment objective of the Vo Chi Cong coastal road completion project is to complete and upgrade the inter-regional traffic system connecting the Cua Dai bridge to Chu Lai Airport. At the same time, forming an arterial traffic route in the coastal area, connecting the inter-regional Da Nang, Quang Nam, and Dung Quat industrial park, Quang Ngai province, connecting the coastal road to Dong Que Son industrial park to National Highway 14H.

-

8. High-end apartment prices escalate due to the scarcity of supply?

Contrary to the situation of selling at the old prices or cutting losses many years ago, luxury apartments are recording a significant increase in the secondary market. This phenomenon comes from the severe shortage of supply in recent years.

Many years ago, when the market’s supply was still abundant, the selling price of luxury apartments on the secondary market in Hanoi was mostly flat or decreased slightly, but in the last 2 years, due to the lack of supply, The selling price of this segment tends to increase significantly.

Prices will continue to rise if new supply remains scarce

A small number of new projects are opened for sale on a drip basis, depending on a few mega-urban projects approved many years ago, causing apartment prices in the primary and secondary markets to increase sharply. Primary projects in two main types, medium and high-end, still recorded a 5-10% increase in popularity in subsequent sales launches in the year.