Each week we post a news flash with notable articles related to the real estate market in Vietnam. We asked our team to pick the top stories from the past month and we’ve tallied the results. Check out the headlines that made big news in our office below. Have any of the articles we’ve shared impacted you? Is there any important news we’ve missed? We’d love to hear from you!

Our CVR team is here to answer your questions at any time. Whether buying, selling, renting, or opening a business, contact us to talk about your real estate needs today.

Your Friends at Central Vietnam Realty.

_________

Content

- 1. Promising Outlook for Real Estate Market as Interest Rates Continuously Decline

- 2. Positive Signs Propel Real Estate Market to New Heights in 2023

- 3. Da Nang and India Strengthen Tourism and Seaport Cooperation, Boosting Investment Opportunities

- 4. Seizing Opportunities in a Buyer’s Market: The Right Time to Invest in Real Estate

- 5. 5 risks when buying a condo you should know to avoid

- 6. Industrial real estate adapts to the global minimum tax

-

JUNE 2023 CENTRAL VIETNAM REAL ESTATE NEWS SUMMARY

-

-

-

1. Promising Outlook for Real Estate Market as Interest Rates Continuously Decline

-

-

Since March, the State Bank has lowered the operating interest rate four times, which is considered a good signal for the economy and is expected to have a positive impact on the real estate market.

On June 16, the State Bank of Vietnam (SBV) issued a decision to adjust interest rates.

-

The maximum interest rate applicable to demand deposits and deposits with a term of less than 1 month remains at 0.5%/year; the maximum interest rate applicable to deposits with a term from 1 month to less than 6 months is reduced from 5%/year to 4.75%/year. Particularly, the maximum interest rate for deposits in VND at People’s Credit Funds and Microfinance Institutions will be reduced from 5.5%/year to 5.25%/year; interest rates for deposits with a term of 6 months or more are set by credit institutions on the basis of market capital supply and demand.

-

-

The decisions to adjust the above interest rates take effect from June 19. This is the 4th time in a row in just the past 3 months that the SBV has reduced operating interest rates to support the economy.

The high anchoring interest rate has impacted the liquidity in the real estate market, which has declined in recent times. In recent months, the SBV has reduced the operating interest rate many times, accordingly, banks have also gradually lowered lending rates. Although the decrease is not much, it shows that a positive signal is coming to the real estate market.

-

According to the VARS assessment, now, there is a signal of money coming back, bond interest rates, interbank interest rates, and deposit interest rates have cooled down, and customers have access to new loans with interest rates of 10 – 11%. However, only when the average interest rate falls below 10% will the real estate market react. Because 10% is a number that investors are able to tolerate when borrowing.

Source: cafef.vn

-

-

2. Positive Signs Propel Real Estate Market to New Heights in 2023

According to many experts, 2023 will record a recovery in the true value of all real estate segments in order to meet the real needs of people.

Over the past time, the Government and ministries, agencies, and sectors have issued many mechanisms and policies that directly and indirectly affect the real estate sector such as Public Power 469/CD-TTg in 2023 on dismantling and promoting the market. The real estate market develops safely, healthily, and sustainably, promulgated by the Prime Minister on May 25, 2023.

-

-

Thanks to policies to remove difficulties for the market from the Government and measures to stimulate the economy; along with that is the strong recovery of the tourism market; Which is the driving force for the real estate market, which will continue to develop and create new opportunities.

Source:diendandoanhnghiep.vn

-

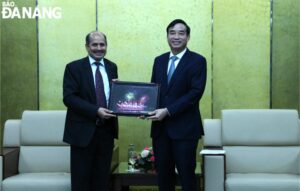

3. Da Nang and India Strengthen Tourism and Seaport Cooperation, Boosting Investment Opportunities

The article discusses a meeting between Da Nang People’s Committee Chairman Le Trung Chinh and Indian Ambassador Sandeep Arya in Vietnam. Chairman Chinh highlighted various sectors in Da Nang that are attractive for investment, including information technology, the high-tech industry, innovative start-ups, seaports, airports, tourism, services, and logistics.

-

Chairman Chinh expressed hope that Ambassador Sandeep Arya would introduce Indian investors who are interested in seaport investment in Da Nang, particularly mentioning the Adani Group’s interest in the Lien Chieu Port project. He also requested the ambassador’s assistance in promoting the opening of direct flights between major Indian cities and Da Nang, aiming to attract more Indian tourists to the city.

Chairman Chinh emphasized the good cooperation between Vietnam and India, with India being the country’s eighth-largest trading partner. However, he highlighted the need to establish friendly cooperative relationships between the localities of India and Da Nang. He sought the ambassador’s help in introducing technological and tourism businesses from India to invest in Da Nang in the near future.

-

Source:baodanang.vn

-

4. Seizing Opportunities in a Buyer’s Market: The Right Time to Invest in Real Estate

Over the past time, the real estate market has witnessed a strong drop in prices, but it is still difficult to find buyers. For those who go to buy real estate at this time, most of them have the psychology of forcing the price to want to buy it at a cheaper price.

The situation of price pressure in the real estate market is now rampant. Buyers want to own at a low price, and sellers expect to save losses

-

Depreciation is the general state of the market, everyone knows this is not a good time to sell real estate. However, the sellers are now in a passive position, forced to sell when they have their own difficulties. Accordingly, these people expect that when they sell, they will still have a portion of the profit for those who have bought for a long time or reduced their losses with newly invested real estate in the past 1 year.

-

On the buyer side, they are dominating because they have cash available, so they have many choices. Accordingly, if they have the mentality, to buy or not, find other real estate. This is the right psychology, especially in the current market where there are more sellers than buyers.

Real estate expert Tran Khanh Quang, general director of Viet An Hoa real estate investment company, said that this is the time to determine the bottom of real estate, which is the buyer’s market.

-

Buyers looking for real estate at a good price, love it, should put down money.

-

Currently, about 20-30% of investors with available cash are going to buy their favorite real estate, good location, good price. These people have “investment blood” in their bodies, just waiting for products with good prices, the right investment needs, and full legality to buy.

The homebuyers are being “strongly” supported by investors in terms of payment policies. Currently, real estate projects have been rebalanced with reasonable prices when they are put on the market. Investors see the difficulty of cash flow, so they are ready to extend the payment schedule. This is an opportunity to buy real estate for both living and investment.

Source:cafef.vn

-

-

5. 5 risks when buying a condo you should know to avoid.

Buying an apartment can be risky, so buyers and investors need to master it so as not to affect their legitimate interests.

The project is open for sale even though it is not eligible

This risk mainly comes from the fact that the buyer does not understand the regulations, has not carefully checked the documents but hastily paid the money.

Although the law requires the project to meet all the conditions prescribed by law to be allowed to do business, in fact, many investors for profit should just do it. Sometimes the project does not have a land use right certificate for the whole project, the application has not been approved but has been opened for sale.

-

-

Mainly for houses to be formed in the future, when wanting to open for sale, the investor must finish building the foundation. Many people need to learn about this regulation leading to risk.

For projects to be formed in the future, especially complexes and apartment buildings, in addition to having the legal documents mentioned in Article 55 of the Law on Real Estate Business, they must complete the construction in the field. foundation, reaching about 20% of the building’s construction progress. In addition, the Department of Construction stipulates that in order for a housing project to be formed in the future to be eligible for business, it must be accepted by the Department of Foundation and published on the official website of the Department of Construction. After satisfying the statutory conditions, the future housing project will be eligible to open for sale.

-

Another important condition is that the project must be guaranteed by a large commercial bank in Vietnam. In order that in the event of an incident, the investor cannot continue to build the project but is forced to refund the investor, the bank will refund first. This is a regulation to protect home buyers, so investors need to understand it to ensure their interests.

- Risks when signing a contract

Buying an apartment for the first time, buyers will not be overwhelmed by the number of different contracts. I thought it was enough to buy a house and sign a purchase and sale contract, but when the broker offered it, I knew there were all kinds of contracts such as “Investment cooperation contract”, “Business cooperation contract”, and “Contribution contract”. capital”…

-

The law clearly states that when buying a house formed in the future, the buyer cannot pay 100% of the house value to the investor. The signed sales contract must show payment in installments according to the construction progress.

That is why investors will circumvent different forms of contracts such as investment cooperation contracts, business cooperation contracts, and capital contribution contracts… Of course, these types of contracts are all incorrect. regulated by the Ministry of Construction, but investors often use it to raise capital illegally.

- Fire prevention and fighting risk

This is a factor that you absolutely need to consider carefully when buying an apartment. Equipment such as whistles, fire alarms, fire extinguishing systems, and fire extinguishers need to be fully prepared and always in a state of readiness, ready to be used immediately if an incident occurs.

-

At the same time, the emergency stairs are also an extremely important factor. Preferably made of iron doors, which are always closed but never locked.

Even when there is an incident, the fire cannot spread to the emergency exit and spread to other floors. If the apartment elevator is unusable, you can use the exit exit.

- Parking dispute

Recently, many disputes over parking spaces between apartment buyers and investors or building management have occurred.

To avoid this hassle when moving into a high-rise apartment building, you need to take the time to carefully study the contract and clearly discuss this issue with the investor.

-

Apartment buyers must be transparent about parking standards before signing the apartment purchase and sale contract. Some points apartment buyers need to pay attention to such as: How many motorbikes and cars can each apartment have? Is parking an add-on included in the price or does it have to be purchased separately/rented for a limited time? If there is a commercial area in the project, will residents share or separate the basement with visitors?

- Risk of buying floors built without permission

For profit, sometimes the investor will intentionally build more than the number of floors according to the permit granted by the authorities. Usually, this mistake will affect the apartments on the top floor.

-

Therefore, if you decide to buy the top floor of the apartment complex, you need to find out if the whole building is built over the floor to avoid problems later.

There have been cases when inspectors discovered violations of building over floors, investors had to demolish or let the top floor become a common living area for all residents.

Source:rd.zapps.vn

-

-

6. Industrial real estate adapts to the global minimum tax

-

-

The industrial property developer’s strategy to adapt to the global minimum tax policy is to invest in improving the industrial park’s infrastructure, providing many utilities, meeting diverse needs and effectively supporting the local community. Investors…

-

Tax incentives are no longer a strength to attract investment

When the global minimum tax is applied, competition to attract foreign investment will depend on the quality and service provided, as the main factors to attract investment from Vietnam are tax and labor incentives. Cheap prices are fading

Industrial real estate will be significantly affected by the global minimum tax policy because, in the past, this field attracted investment mainly thanks to tax incentives and cheap labor.

-

The global minimum tax is an agreement that the G7 countries reached in June 2021 to combat the fact that multinational corporations “dodge” taxes by relocating profits to other tax havens or doing business. transnational digital business without a physical presence. The minimum applicable is 15%, for multinational enterprises with total consolidated revenue of 750 million euros (equivalent to 800 million USD) or more in 2 years of the last 4 consecutive years. It is expected that this tax policy will be applied in 2024.

-

Long-term direction

In order to strongly attract capital flows, industrial real estate developers need to invest and further improve the quality of industrial park infrastructure in a synchronous and modern direction, providing the most utilities for investors.

-

This is also a long-term direction because tax incentives are just one of the factors for investors to consider making investment decisions. In fact, they always prioritize choosing a safe and stable destination to ensure the project is deployed smoothly, preserve capital, and increase profits.

- Source:baodautu.vn

-

As always, CVR is at your service and happy to provide help anyways we can!

Contact Us today to find the real estate investment in Da Nang which is right for You

-

According to many experts, 2023 will record a recovery in the true value of all real estate segments in order to meet the real needs of people.

According to many experts, 2023 will record a recovery in the true value of all real estate segments in order to meet the real needs of people. Chairman Chinh expressed hope that Ambassador Sandeep Arya would introduce Indian investors who are interested in seaport investment in Da Nang, particularly mentioning the Adani Group’s interest in the Lien Chieu Port project. He also requested the ambassador’s assistance in promoting the opening of direct flights between major Indian cities and Da Nang, aiming to attract more Indian tourists to the city.

Chairman Chinh expressed hope that Ambassador Sandeep Arya would introduce Indian investors who are interested in seaport investment in Da Nang, particularly mentioning the Adani Group’s interest in the Lien Chieu Port project. He also requested the ambassador’s assistance in promoting the opening of direct flights between major Indian cities and Da Nang, aiming to attract more Indian tourists to the city. Depreciation is the general state of the market, everyone knows this is not a good time to sell real estate. However, the sellers are now in a passive position, forced to sell when they have their own difficulties. Accordingly, these people expect that when they sell, they will still have a portion of the profit for those who have bought for a long time or reduced their losses with newly invested real estate in the past 1 year.

Depreciation is the general state of the market, everyone knows this is not a good time to sell real estate. However, the sellers are now in a passive position, forced to sell when they have their own difficulties. Accordingly, these people expect that when they sell, they will still have a portion of the profit for those who have bought for a long time or reduced their losses with newly invested real estate in the past 1 year. The project is open for sale even though it is not eligible

The project is open for sale even though it is not eligible