Week 24/2025 – Central Vietnam Real Estate News Summary

In this weekly or sometimes bi-weekly news flash – CVR: Central Vietnam Realty will provide a choice of articles from mainly Vietnamese media sources related to the real estate market in Vietnam.

We will be focusing on issues related to Da Nang and Hoi An, while also looking at national news and their possible impact on Central Vietnam’s property market.

You will find a summary, a link to the source as well as CVR’s take on the article.

We believe that local knowledge is the key to making the best possible decision and that’s what we offer to all our clients.

“CVR: Western Management – Local Knowledge”

1. Quang Nam Approves Master Plan For 744-Hectare Tam Hoa Non-Tariff Zone.

-

On 24th June, 2025, Quang Nam Province’s People’s Council approved a zoning plan for a 744‑hectare non‑tariff zone at Tam Hoa Port, fully integrated within the Chu Lai Open Economic Zone. The plan allocates 489 ha for industry, warehousing, and port operations, along with commercial, infrastructure, green, public, and security lands. The area is divided into an administrative-commercial core, an industrial-warehouse cluster, and a port-logistics hub, featuring a riverside commercial strip and logistics center.

-

As part of Chu Lai OEZ, the zone will benefit from preferential incentives matching Da Nang FTZ, including corporate income tax breaks, import-duty exemptions, VAT refunds, and automatic Export Processing Enterprise status. This development, with the new merging policy, Quang Nam province will be merged to Da Nang city from July 1, positions the region as a prime destination for FDI across manufacturing, finance, commerce, IT, and high-tech sectors—backed by strategic coastal/logistics infrastructure and competitive policies.

Source: en.baodanang.vn

2. Tax On 2nd Property To Cool Down The Housing Price.

Recently, house and land prices in Hanoi, Ho Chi Minh City, and nearby areas have surged, limiting people’s access to housing. To address this, the Government has assigned the Ministry of Finance to study real estate tax solutions aimed at stabilizing prices. Deputy Prime Minister Tran Hong Ha emphasized the need for progressive taxes on abandoned or inefficiently used land, while avoiding negative impacts on agricultural land accumulation. Experts also warn that over-taxing could affect production and economic growth, as real estate remains a key growth driver. The Government faces the challenge of balancing tax policies with market development.

In Da Nang, a rapidly growing hub for tourism and real estate, the property market has seen significant price surges, particularly in coastal and urban areas. The city’s appeal as a prime investment destination has driven demand for luxury properties and second homes, further fueling price increases. Targeted taxation on second properties could help moderate speculative buying in Da Nang, making housing more accessible for local residents while preserving the city’s economic momentum.

Importance: The proposed tax policies will initially be implemented in major cities like Ho Chi Minh City and Hanoi, with plans to extend them to smaller but fast-growing cities such as Da Nang, Ha Long, and Can Tho. In Da Nang, where a booming real estate sector is driven by tourism and infrastructure development, such measures could play a critical role in ensuring sustainable growth and affordability in the housing market.

Source: cafebiz.vn

3. Post-Merger, Da Nang – Hoi An Real Estate Enters A ‘Golden Cycle’.

The July 1, 2025 merger of Da Nang and Hoi An has ushered in a new development era, with international financial centers, free trade zones, and modern infrastructure driving strong investment momentum. This historic event is expected to transform the region into a major growth hub of Central Vietnam, similar to the expansion seen in Hanoi years ago. In particular, the real estate market is gaining significant attention, with high-end low-rise projects like Casamia Balanca Hoi An standing out thanks to strategic location, sound planning, and strong investment potential.

Casamia Balanca Hoi An is located along the key Vo Chi Cong arterial route, linking vital industrial, tourism, and heritage zones. Land prices here remain competitive compared to central Da Nang, offering a golden opportunity for early investors before prices are expected to surge. With a rare riverside eco-urban setting, low construction density, premium amenities, and flexible living or rental options, Casamia Balanca is positioned as a standout investment with projected returns up to 9% annually.

Source: thanhtra.com.vn

4. Saving Through Real Estate: What Are Young Vietnamese Under 30 Planning For Their Future?

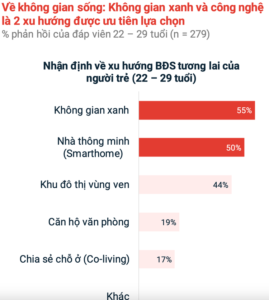

With a bold, future-focused mindset, Generation Z (born 1995–2009) is becoming a driving force in Vietnam’s real estate market. Along with Millennials, they make up 44% of the population, with nearly 70% considered potential buyers, tenants, or investors. Unlike previous generations, Gen Z has early financial awareness and is eager to build passive income streams. Despite being tech-savvy and adventurous, they remain cautious, favoring moderately priced real estate in satellite areas near Ho Chi Minh City to safely test the market and secure long-term financial stability.

Beyond price, Gen Z prioritizes projects with green space, modern technology, and integrated lifestyle facilities. Developments like La Pura, located along National Highway 13, stand out with their unique design, lush green areas, easy connectivity to central Ho Chi Minh City, and a wide range of amenities. With upgraded infrastructure and convenient transport links, these projects perfectly align with Gen Z’s desire for both smart investment opportunities and a healthy, modern living environment.

Source: batdongsan.com.vn

5. Real Estate Tax Valuation From July 1st: Key New Points To Note.

Starting July 1, 2025, Vietnam’s real estate tax calculation will undergo major changes under Decree 181/2025/NĐ-CP, which provides detailed guidelines for applying value-added tax (VAT) to real estate transactions. A key highlight is that land-use fees or land rental costs already paid to the state budget will be excluded from the VAT calculation. The Decree clarifies various scenarios, such as land allocated or leased by the state, land-use right transfers, land contributed as capital, and land payment under PPP projects. For apartment buildings, deductible land value is calculated per unit based on the total land value and usable floor area, excluding shared spaces like hallways or basements.

These new regulations are expected to enhance transparency and reduce tax disputes in the real estate sector. They also help businesses actively plan their financial costs and support tax authorities in better managing real estate operations, limiting revenue loss. The new Decree takes effect from July 1, 2025.

Source: laodong.vn

-

-

As always, CVR is at your service and happy to provide help anyways we can!

Contact Us today to find the real estate investment in Da Nang that is right for You.

-