Each week we post a news flash with notable articles related to the real estate market in Vietnam. We asked our team to pick the top stories from the past month and we’ve tallied the results. Check out the headlines that made big news in our office below. Have any of the articles we’ve shared impacted you? Is there any important news we’ve missed? We’d love to hear from you!

Our CVR team is here to answer your questions at any time. Whether buying, selling, renting, or opening a business, contact us to talk about your real estate needs today.

Your Friends at Central Vietnam Realty.

_________

Content

- 2. Starting From October 4, What Are The Penalties For Transferring Land Use Rights Without Registering Land Use Changes?

- 3. The Lowest Home Loan Interest Rate Ever.

- 4. Currently, The Law In General And The Land Law In Particular Do Not Regulate Or Explain What Is Adjacent Land.

- 5. The Future Of Real Estate In Da Nang Shifts Toward The Northwest.

6. Real Estate To Lead Market Profit Growth In 2025, Surpassing Banks, Securities, And Steel.

-

OCTOBER 2024 CENTRAL VIETNAM REAL ESTATE NEWS SUMMARY

1. Forecast For The Vietnamese Real Estate Market In 2024.

-

-

The Vietnamese real estate market in 2024 is expected to see price increases due to changes in the legal framework and cost factors. Three new laws (Housing Law 2023, Real Estate Business Law 2023, Land Law 2024) impose stricter requirements on investors, contributing to higher prices across various real estate types.

-

Land prices are likely to rise from more frequent updates and the removal of price brackets, enhancing valuation accuracy. Stricter regulations on land use rights certification will also put upward pressure on prices.

-

Prices for primary real estate will increase alongside costs related to site clearance and resettlement, which demands higher-quality housing with complete infrastructure. Additionally, prices for private homes and land lots will rise, driven by investment in urban real estate projects.

-

Development phase requirements for minimum equity will increase costs. Projects smaller than 20 hectares need at least 20% equity, while larger projects require 15%. Investors must also provide complete project information before sales.

-

New payment regulations, including limits on deposits and lower initial payment requirements, will further impact the market. These changes aim to enhance transparency, protect consumer rights, and suggest that real estate prices will continue to rise.

Source: batdongsan.com.vn

-

2. Starting From October 4, What Are The Penalties For Transferring Land Use Rights Without Registering Land Use Changes?

-

Starting from October 4, 2024, new regulations regarding the transfer of land use rights (sổ đỏ) will take effect, significantly impacting land transactions. Transferring a sổ đỏ without registering land use changes will incur fines ranging from 2 to 3 million VND, encouraging citizens to complete all legal procedures related to their property.

-

The transfer of a sổ đỏ is a mandatory procedure for the government to manage land use rights. According to Article 133 of the 2024 Land Law, individuals receiving land use rights must obtain confirmation from the competent authority. If they fail to register changes within 30 days, they will face administrative penalties.

-

Decree 123/2024/NĐ-CP specifies the fines: 1 to 2 million VND for failing to register land use for the first time, and 2 to 3 million VND for not registering land use changes, including transfers and donations. Citizens should be aware of these regulations to avoid fines and protect their legal rights in real estate transactions.

-

Not completing the registration process can lead to legal complications and affect ownership rights. The fulfilling all procedures related to land use rights is crucial for ensuring transparency and legality in real estate dealings. Citizens should proactively seek to understand and comply with these regulations to safeguard their interests.

Source: cafef.vn

3. The Lowest Home Loan Interest Rate Ever.

-

Current home loan interest rates in Vietnam are at historic lows, yet the demand remains low due to rising home prices. Agribank offers attractive fixed-rate packages, starting at 6% for the first 6 months and up to 7% for the first 24 months, depending on the loan term. Despite these offers, home loan demand has not met expectations, primarily due to affordability challenges in the real estate market. BIDV offers minimum rates starting at 5% in Hanoi and Ho Chi Minh City, with other areas seeing rates between 6% and 7%. Other banks, including VietinBank and Vietcombank, have post-promotional rates between 5.5% and 9%.

-

While business credit in real estate has increased, consumer home loans have grown by just over 1%, signaling a slow recovery. Experts argue that current incentive packages are ineffective without further adjustments in rates and loan terms, as high home prices continue to hinder homeownership for many Vietnamese buyers.

Source: cafef.vn

4. Currently, The Law In General And The Land Law In Particular Do Not Regulate Or Explain What Is Adjacent Land.

-

Adjacent land is the area of land adjacent to residential land in a plot of land with many different types of land. Legally, adjacent land has no specific boundaries, and at the same time, mainland land is usually non-agricultural land, not residential land, and other types of agricultural land such as annual crop land, perennial crop land, etc. adjacent to the land area within the same plot of land.

When is adjacent land converted into residential land? Points b and dd, Clause 1, Article 121 of the Land Law 2024 stipulates as follows: Cases of changing land use purposes that require permission from competent state agencies include:

– Converting agricultural land to non-agricultural land;

– Converting non-agricultural land that is not residential land to residential land.Source: kinhtedothi.vn

5. The Future Of Real Estate In Da Nang Shifts Toward The Northwest.

Experts believe Da Nang’s real estate focus is shifting to the Northwest, a region now poised for major development through 2050. Architect Tran Ngoc Chinh from the Vietnam Urban Planning Development Association describes it as a new economic growth hub, fueled by extensive infrastructure investments and large-scale projects. The National Assembly recently approved a free trade zone centered on Lien Chieu Port, designed to include manufacturing, logistics, and high-end services, attracting both local and international investment.

-

The Lien Chieu Port itself, spanning 450 hectares, aims to relieve pressure on Tien Sa Port while creating an international transit center by 2025. This expansion could draw 60,000–70,000 new residents and workers to the area, boosting employment and living standards. Da Nang’s long-term vision includes further land development and strategic investor outreach, reducing dependence on tourism by diversifying the city’s economy. Experts anticipate that the Northwest will become Da Nang’s next key economic hub, blending industrial growth with infrastructure and social benefits.

Source: cafef.vn

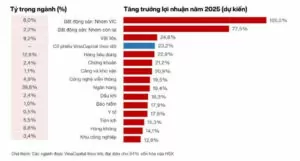

6. Real Estate To Lead Market Profit Growth In 2025, Surpassing Banks, Securities, And Steel.

According to Michael Kokalari, VinaCapital’s Chief Economist, Vietnam’s GDP growth will shift toward internal drivers in 2025, which could positively impact the stock market. VinaCapital projects that real estate will lead profit growth on the VN-Index due to anticipated growth in real estate development. The firm predicts Vietnam’s GDP will grow 6.5% in 2024 and 2025, with consumer spending and infrastructure investment playing significant roles. Expected EPS growth for the VN-Index could rise from 18% in 2024 to 23% in 2025, led by real estate companies.

The report highlights that Vietnam’s ROE is projected at 16%, with a net debt-to-equity ratio of around 24%, making it competitive among regional emerging markets. Vietnam’s forward P/E valuation of around 10x is 25% lower than regional peers, presenting an attractive investment opportunity. Despite foreign investors selling $2.6 billion in Vietnamese stocks due to political and currency concerns, currency stabilization and efforts to elevate Vietnam’s market classification could encourage foreign investment in 2025.

Source: baomoi.com

-

-

As always, CVR is at your service and happy to provide help anyways we can!

Contact Us todayto find the real estate investment in Da Nang that is right for You.